As we head into the fall, the U.S. real estate market is seeing significant changes, with the Federal Reserve cutting its benchmark rate for the first time since 2020. Mortgage rates are falling to levels not seen since early 2023, sparking renewed interest in home buying and refinancing. While home sales showed some seasonal weakening in August, a combination of lower rates and increased inventory could set the stage for stronger activity in the coming months. In this update, we’ll explore how these economic factors are shaping market trends, including home price forecasts, buyer behavior, and the growing impact of rising inventory levels.

The following economic indicators have large ramifications for the housing market, the national economy, and the confidence people have regarding the future.

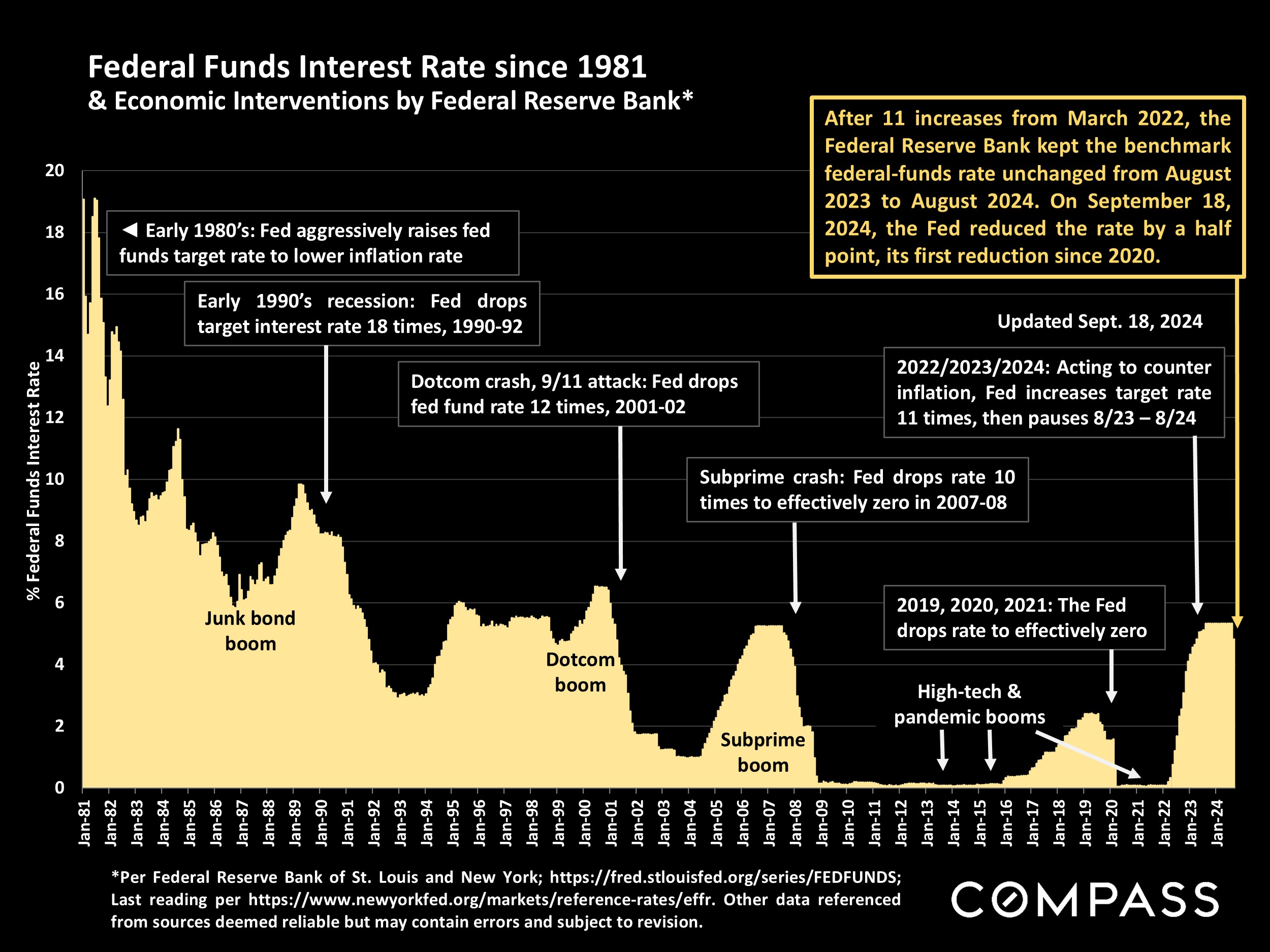

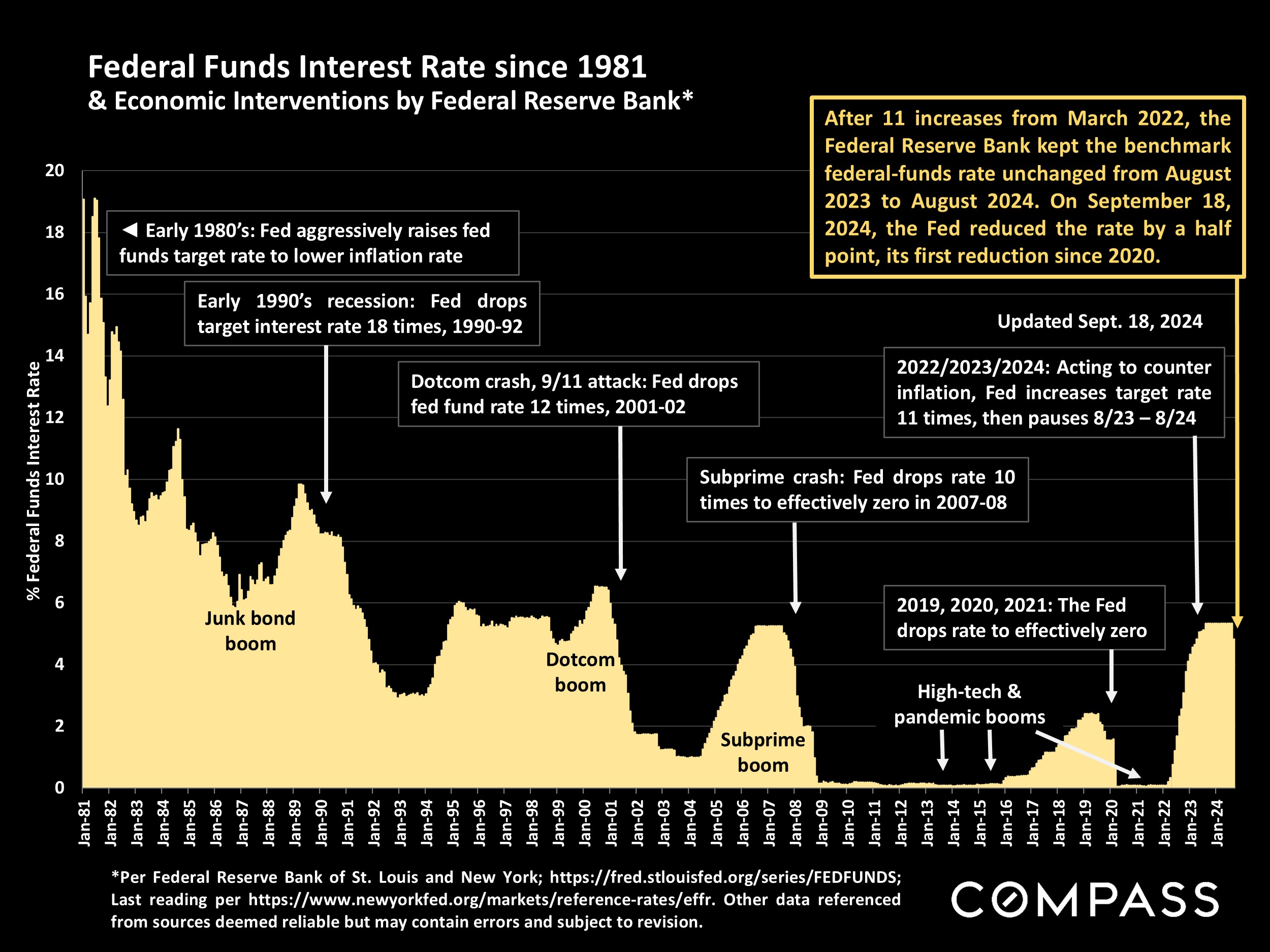

The Federal Reserve Bank just reduced its benchmark rate for the first time in over 4 years. As illustrated below, once it determines that a change is warranted, the Fed can make significant adjustments quite quickly.

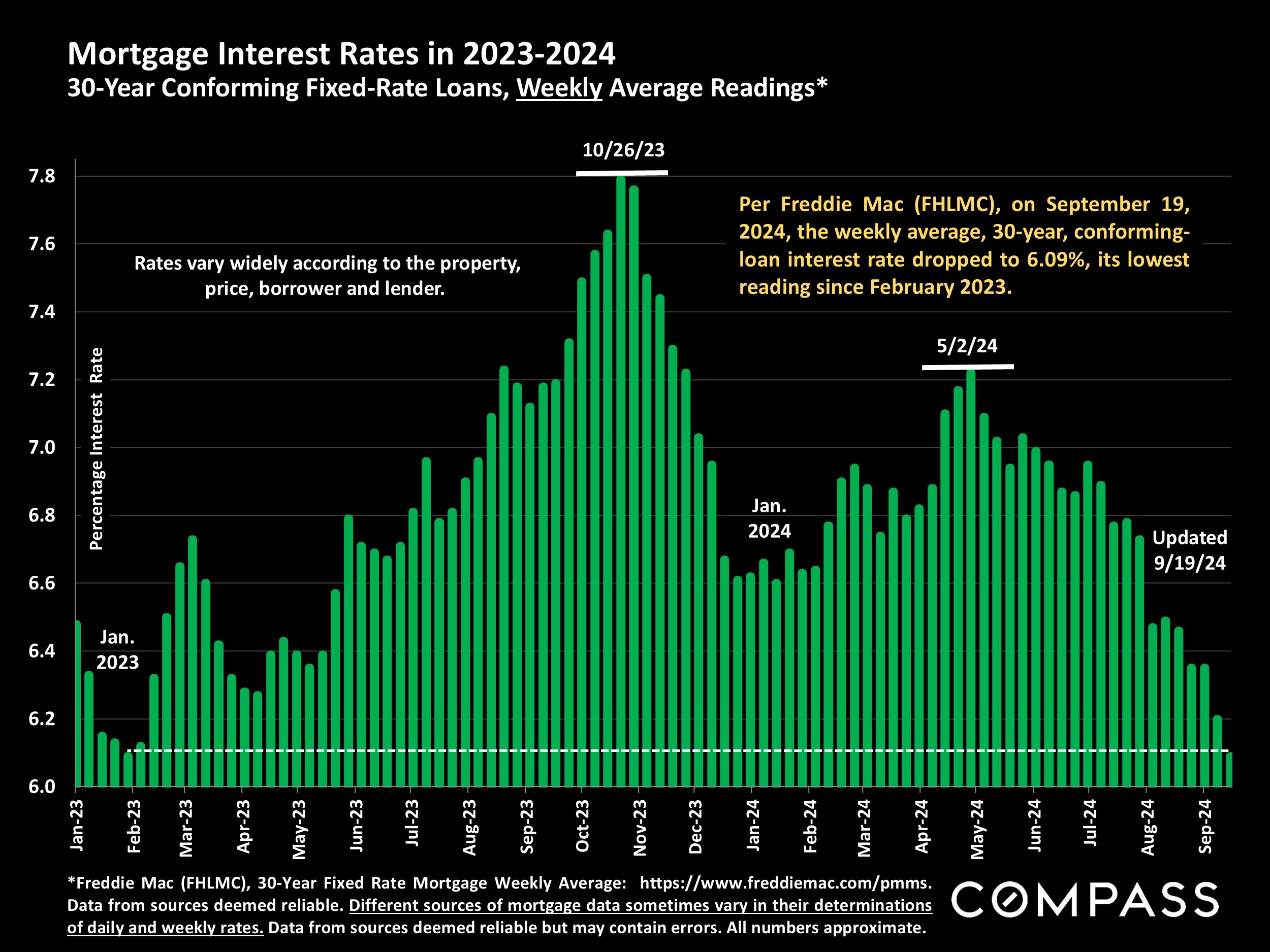

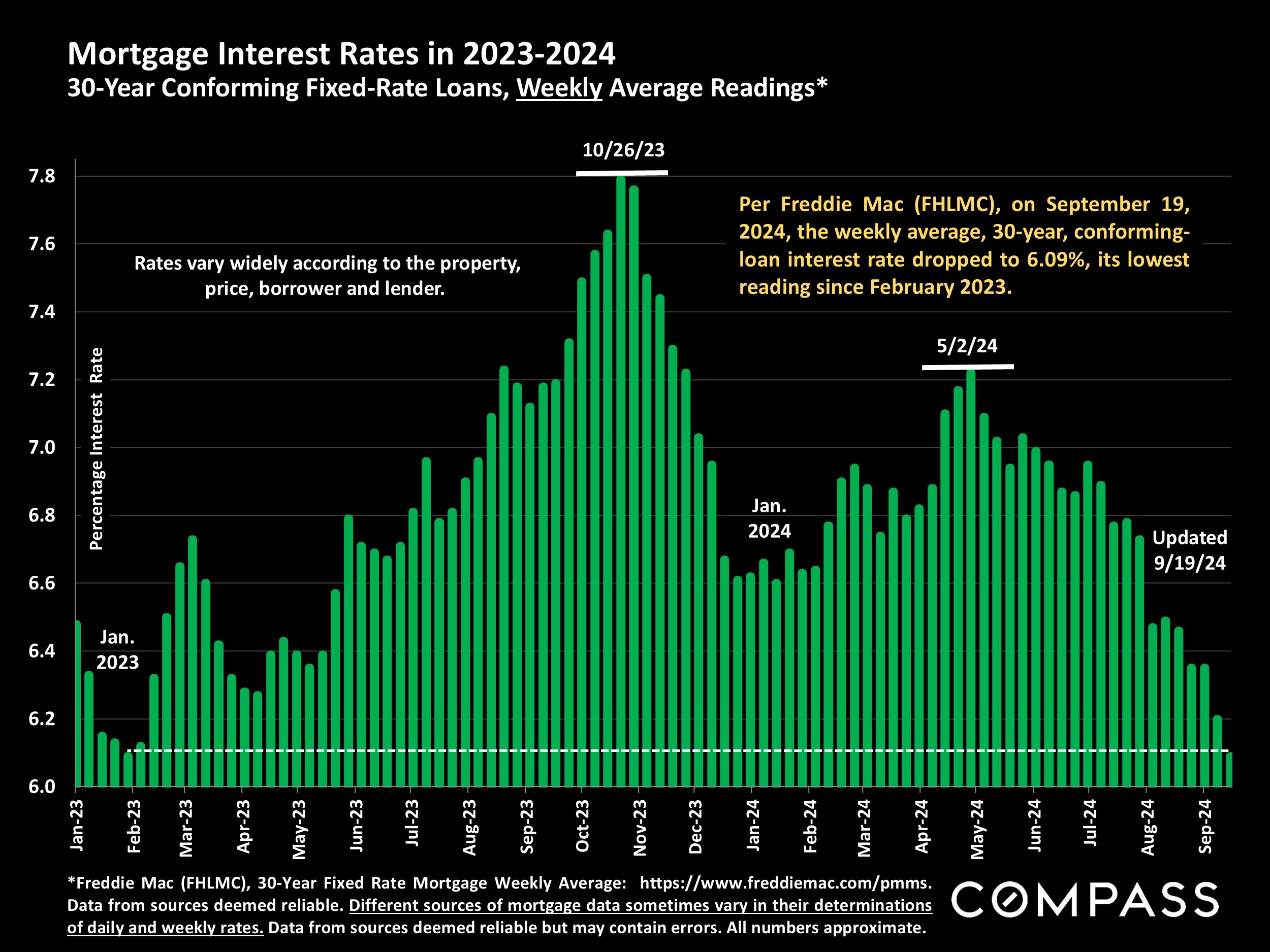

Interest rates have dropped substantially and it is commonly believed they will continue to decline in the near future – but predicting interest rate changes can be challenging to even the most qualified economists.

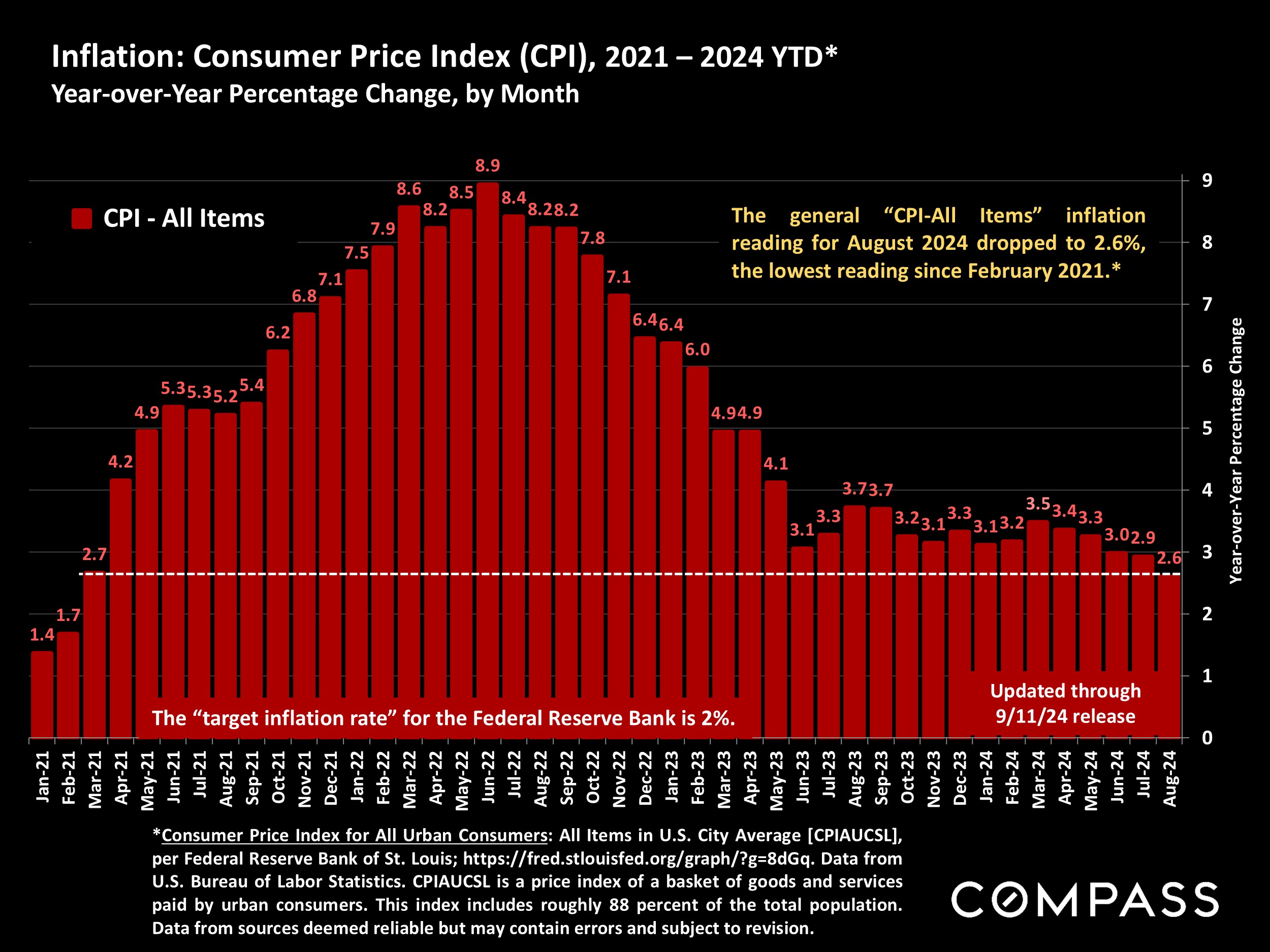

Probably the most critical economic trend is that inflation has dropped to its lowest reading since early 2021, and getting close to the Fed’s target of 2%.

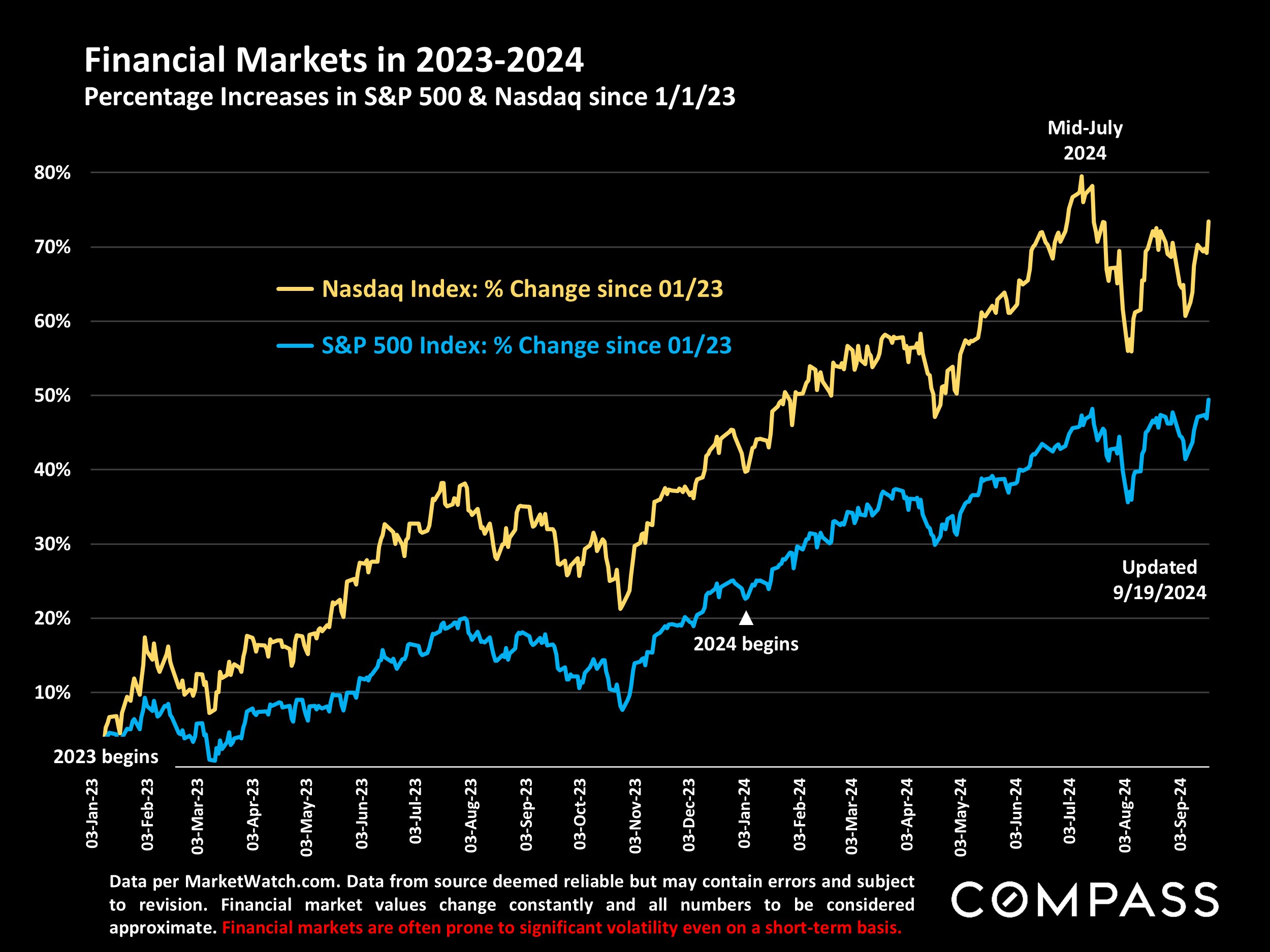

Since mid-July, stock markets have seen some dramatic volatility, but as of 9/19/24, the S&P 500 and Nasdaq were both way up year-to-date, and the S&P and the Dow (not illustrated below) hit new all-time highs.

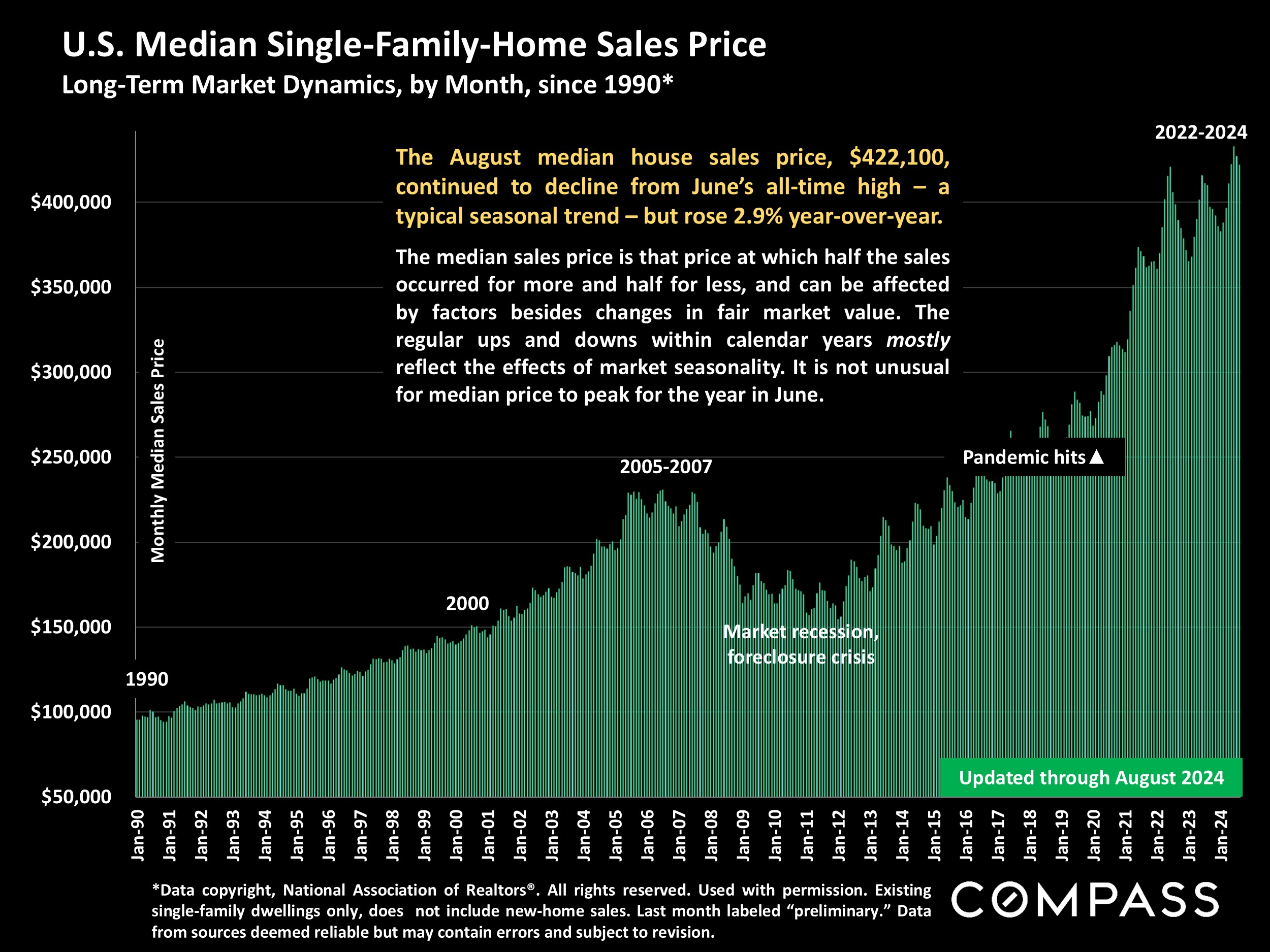

The national median house sales price since 1990: August was slightly down from the recent peak in June 2024 (a normal seasonal trend).

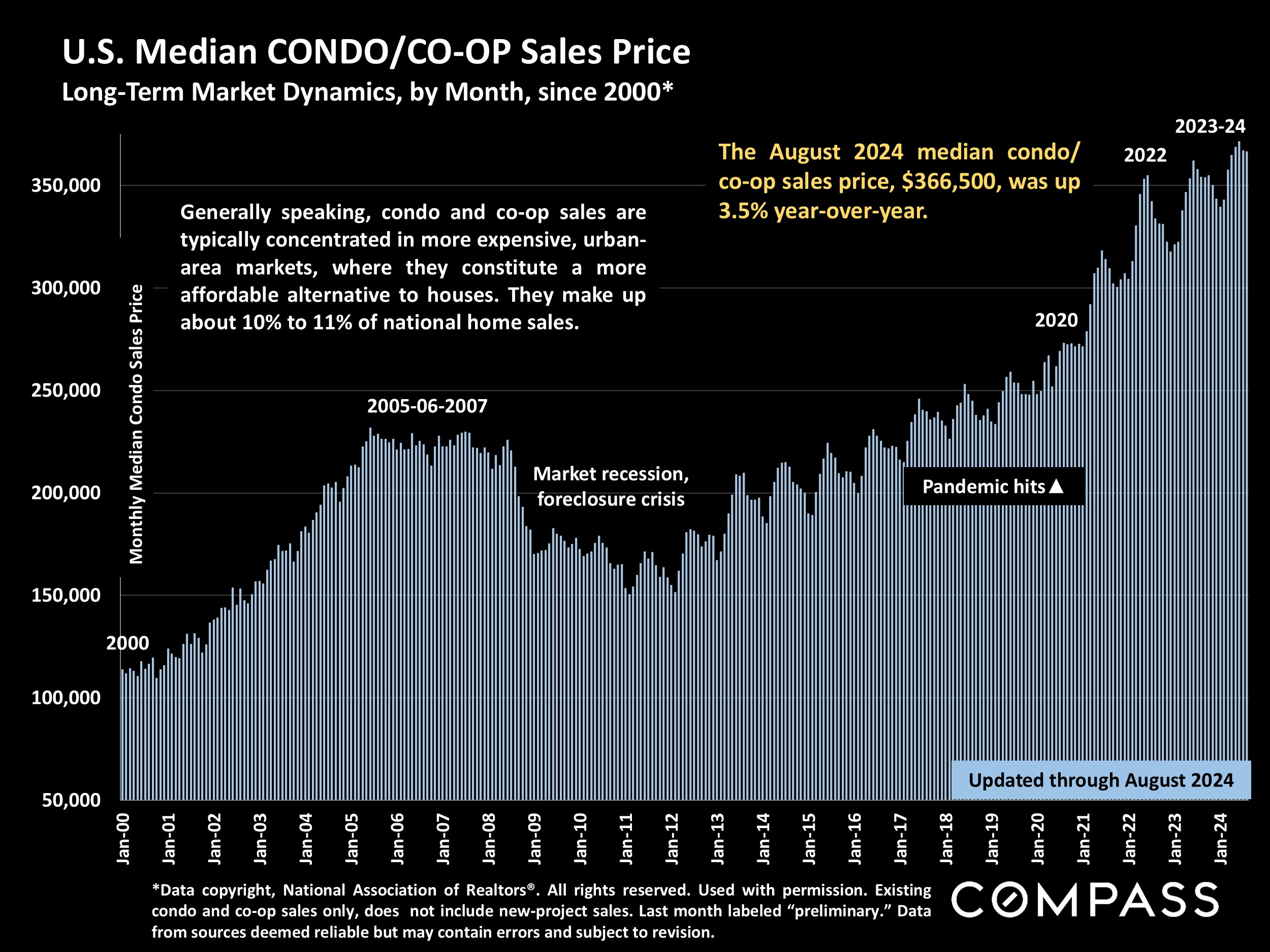

The U.S. median condo/co-op sales price since 2000: August was slightly down from the recent high in June 2024.

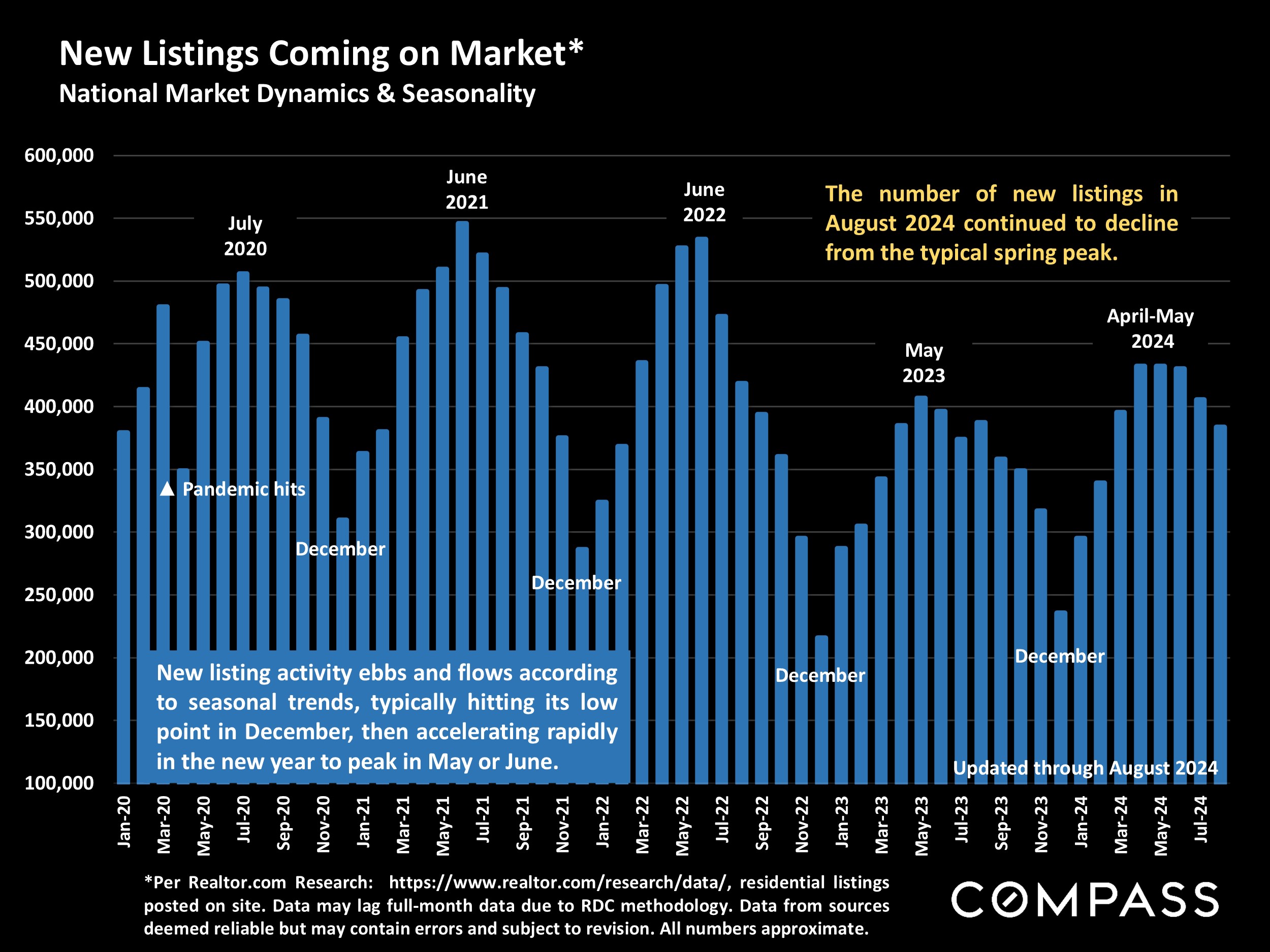

As is the usual seasonal trend, the monthly number of new listings continued to fall from the spring high. Year over year, new-listing activity in August was basically flat compared to August 2023.

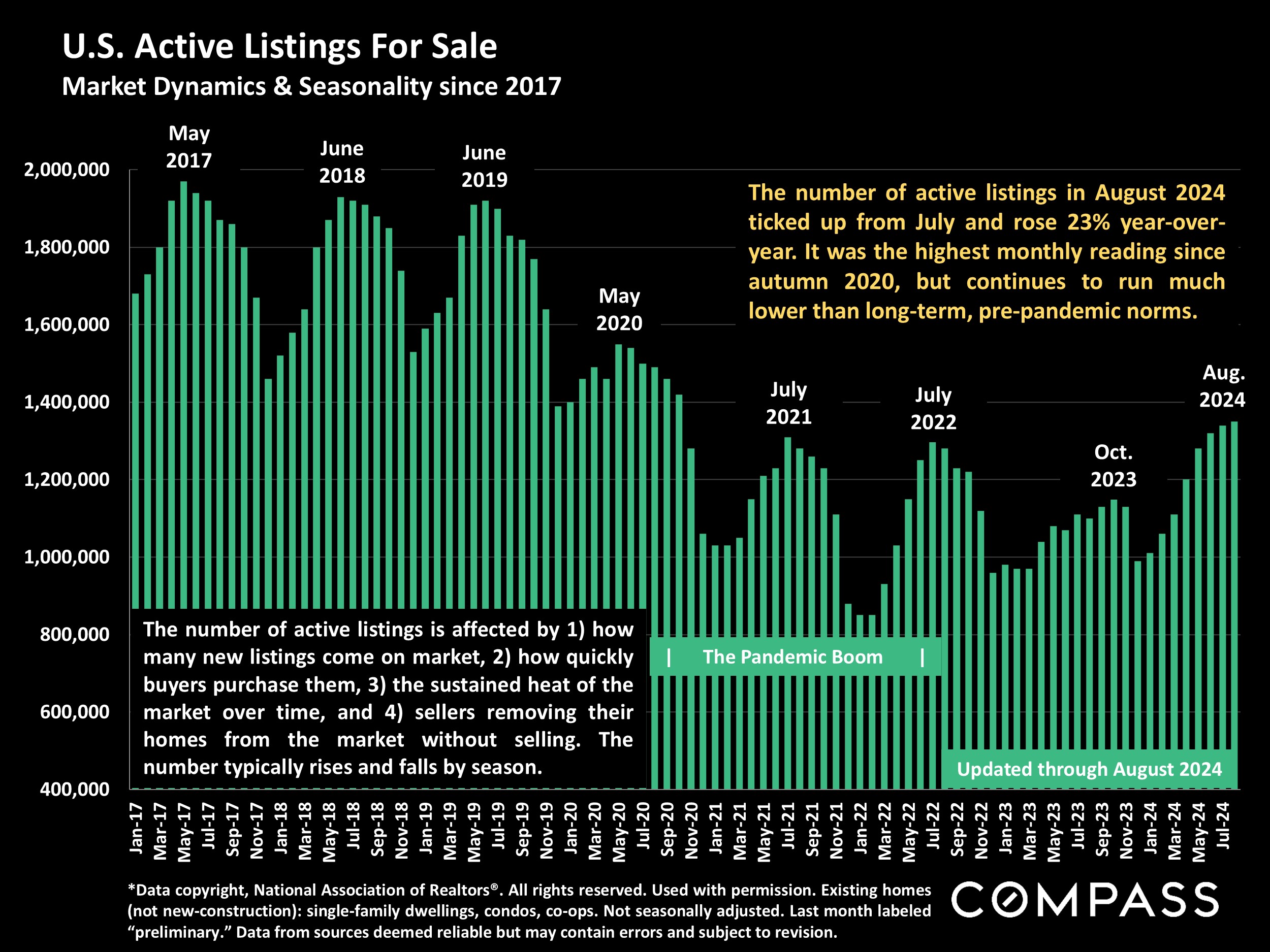

The quantity of homes for sale has been rising and in August hit its highest monthly count in almost 4 years – but the number remains low by long-term standards.

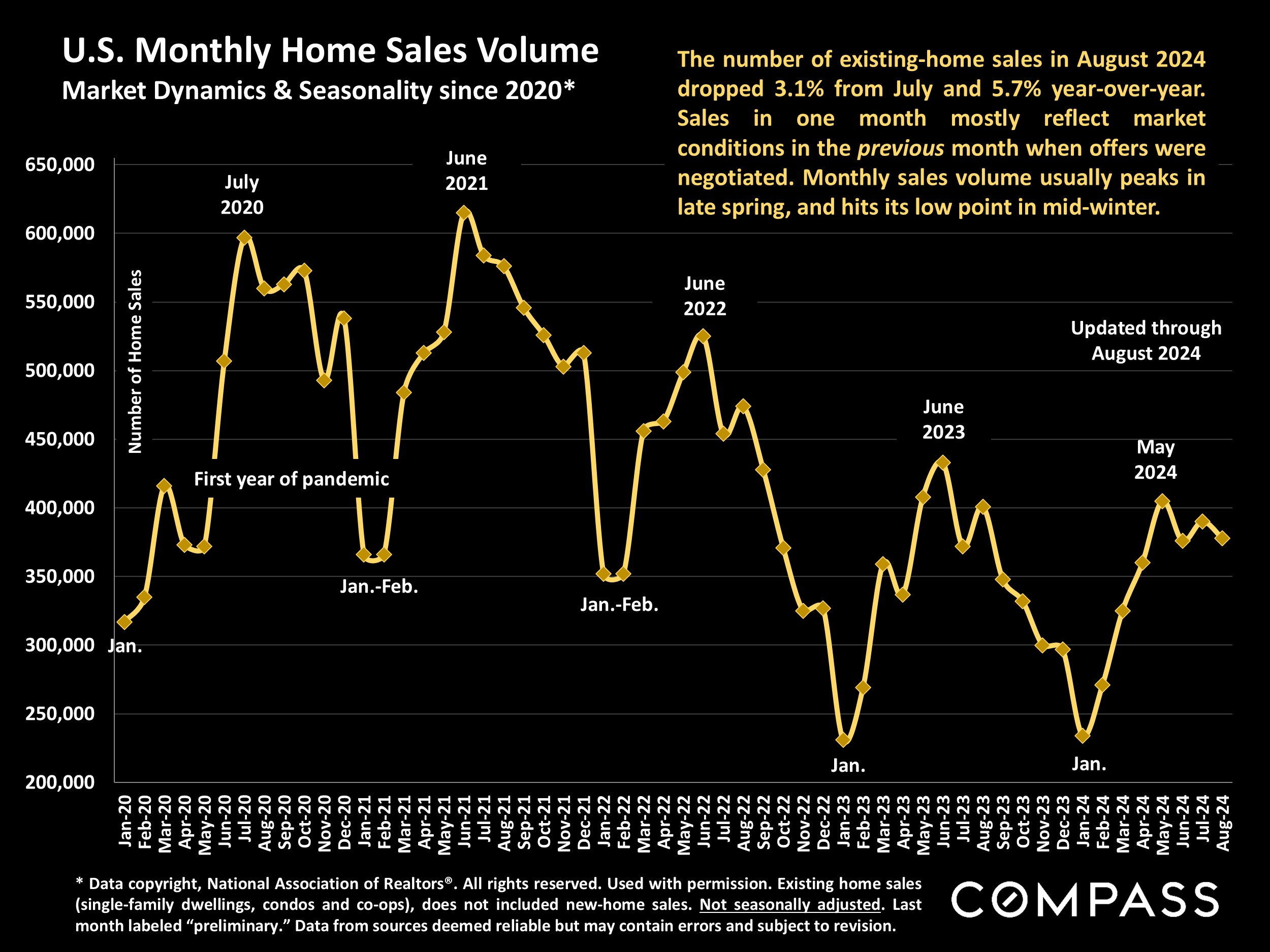

Sales volume in August declined from July and year-over-year, but August sales generally won’t reflect the effects – still to be determined – of recent changes in economic conditions, such as the considerable decline in interest rates.

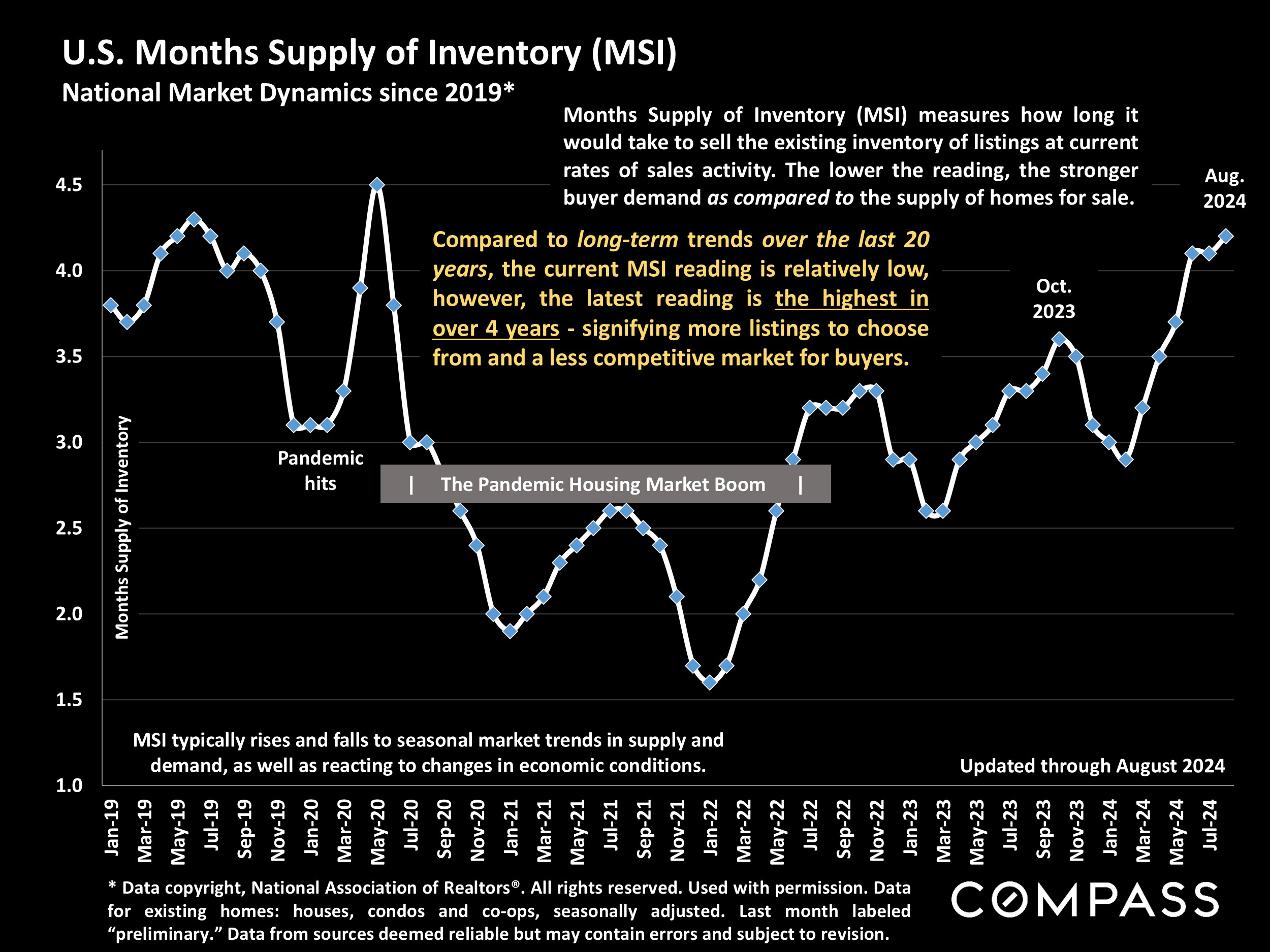

Months Supply of Inventory is a measurement of buyer demand vs. the supply of homes for sale, i.e. how long it would take to sell the current inventory of listings at the existing rate of sale. With active listings up and sales volume down, MSI has increased to a 4-year high, which is a shift to buyers’ advantage.

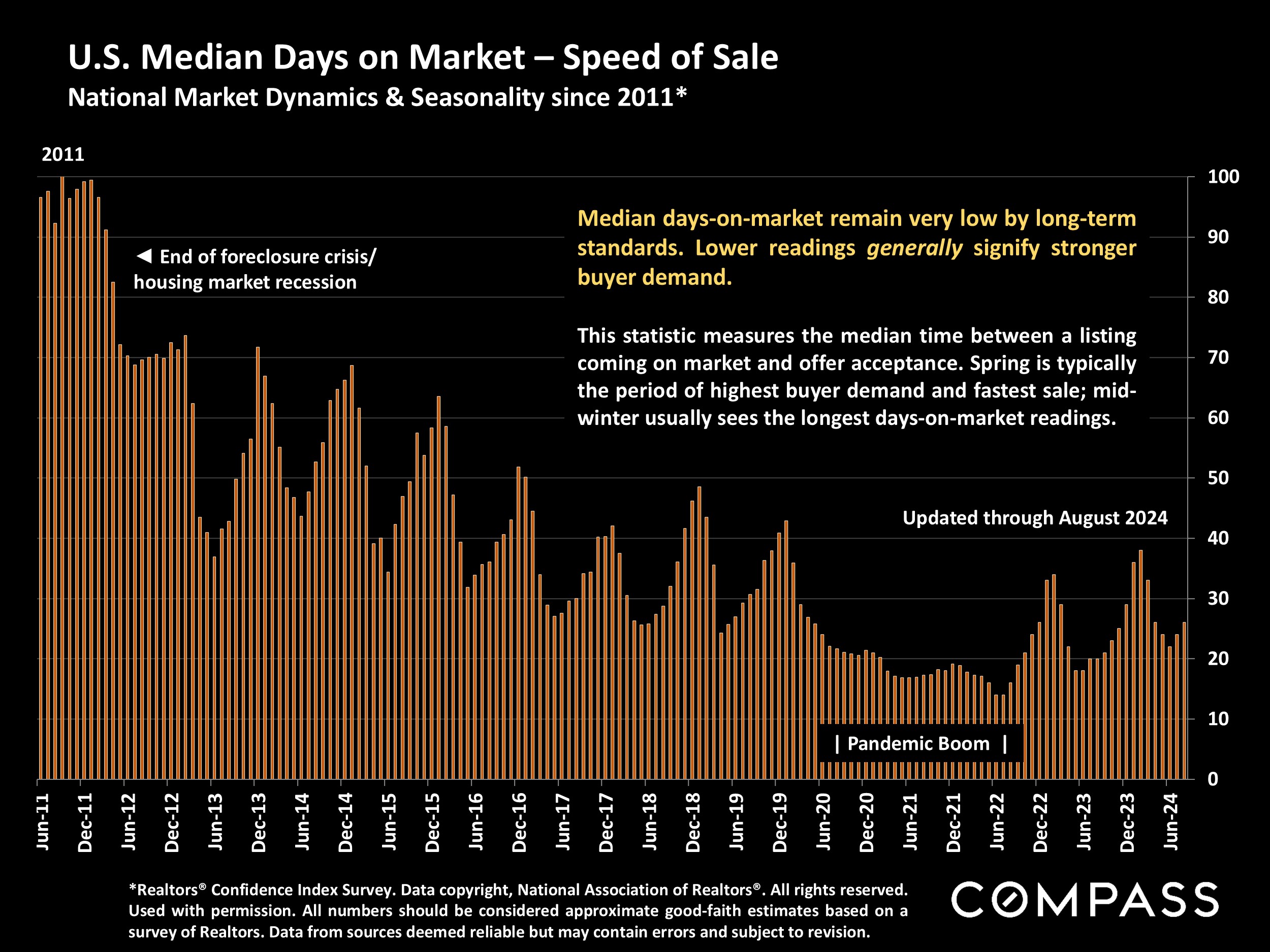

Those homes which sell typically go into contract relatively quickly, but not quite as quickly as in spring or compared to the very heated market of the pandemic boom.

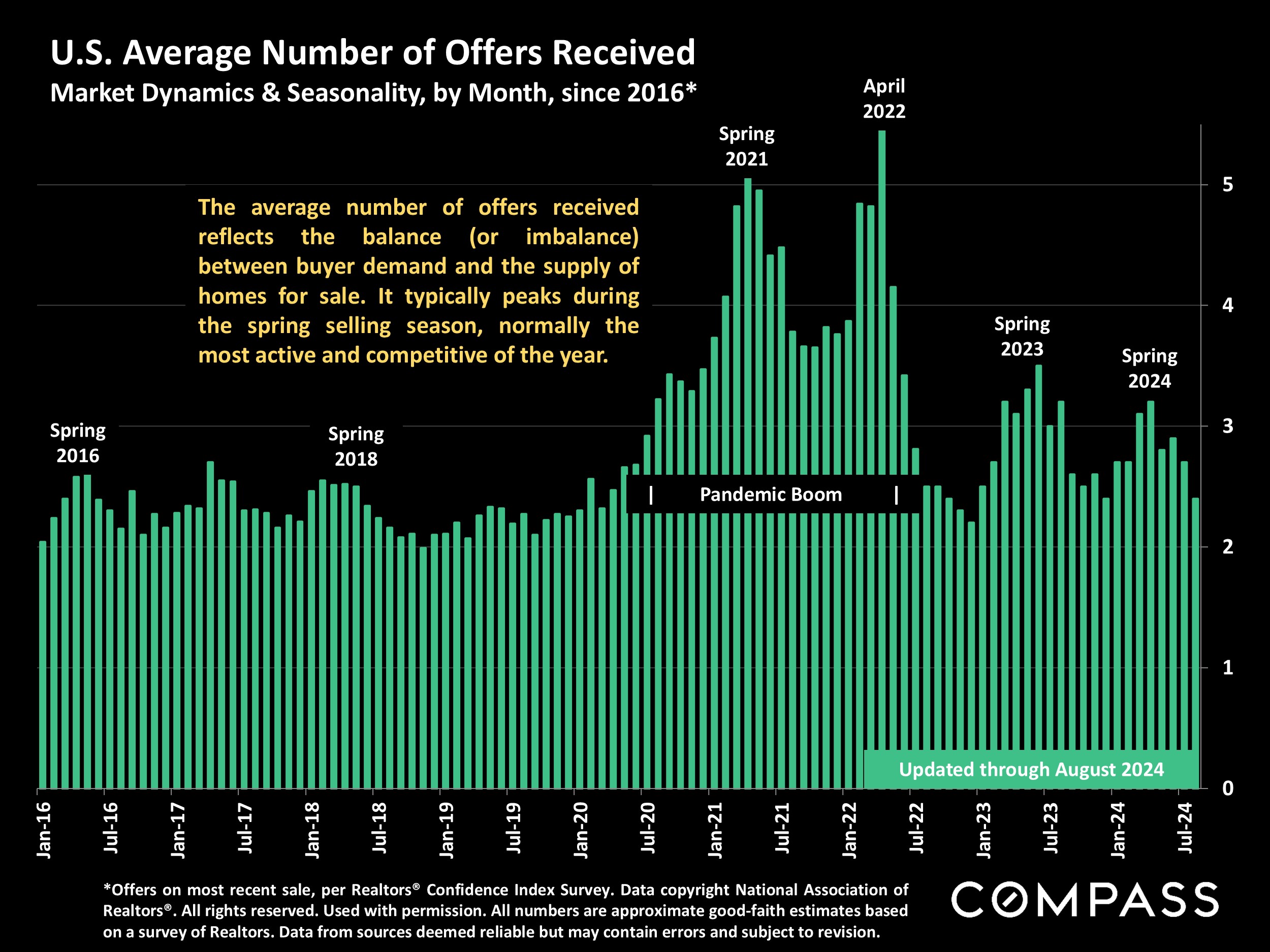

The same trends in demand illustrated above in median days-on-market are also found in the average number of offers received on listings sold: Cooler market conditions than in spring, much cooler than during the pandemic boom.

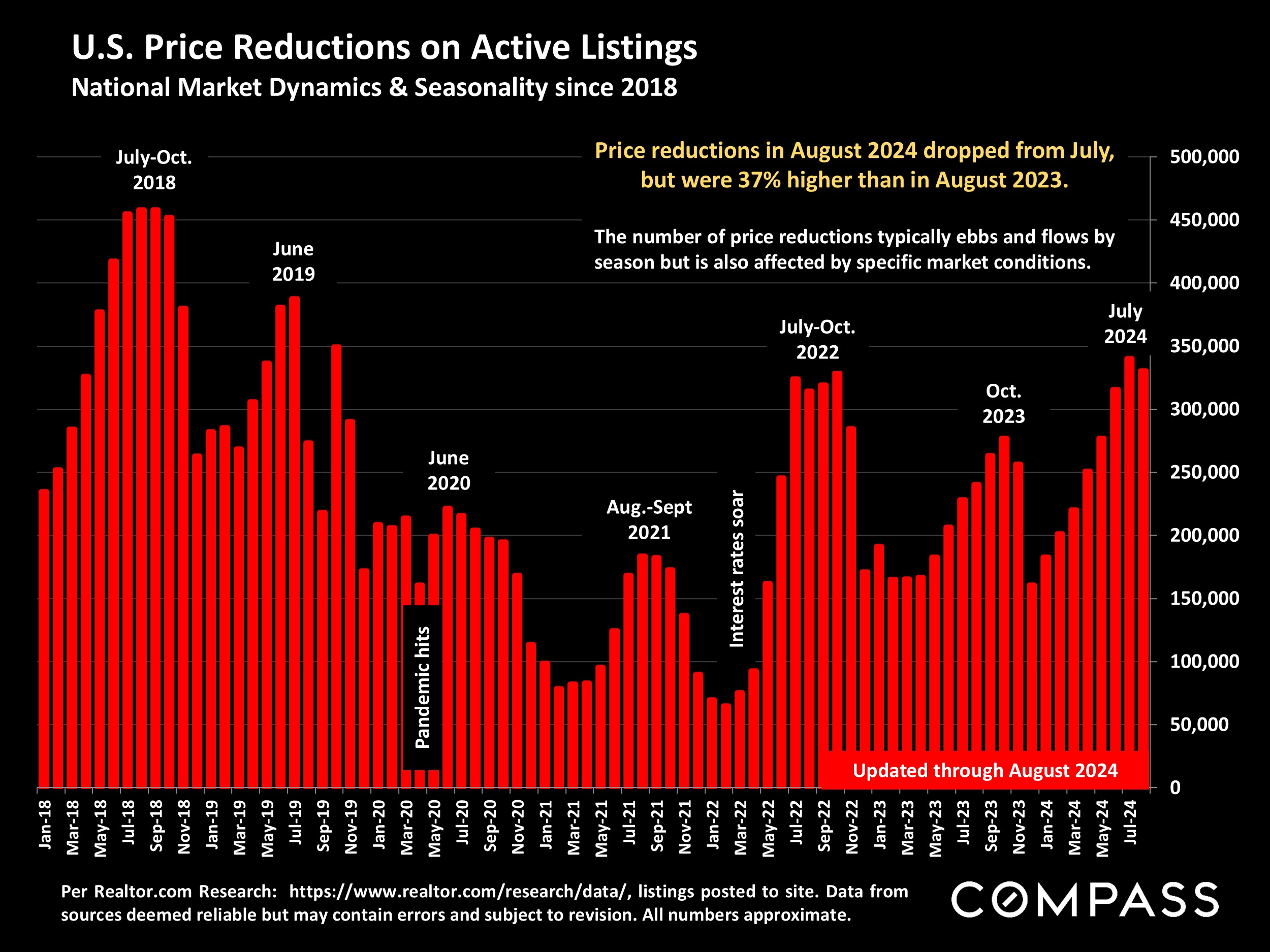

The number of price reductions ticked down in August from July, but is generally running higher than at any time since the effect of soaring interest rates in 2022.

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).