There are a number of reasons you may be thinking about selling your house. And as you weigh your options, you may find you’re unsure how you’re going to deal with one thing about today’s housing market – and that’s affordability. If that’s your biggest concern, understanding how much equity you have in your house could help make your decision that much easier. Here are two key factors that have a big impact on your equity.

How Long You’ve Been in Your Home

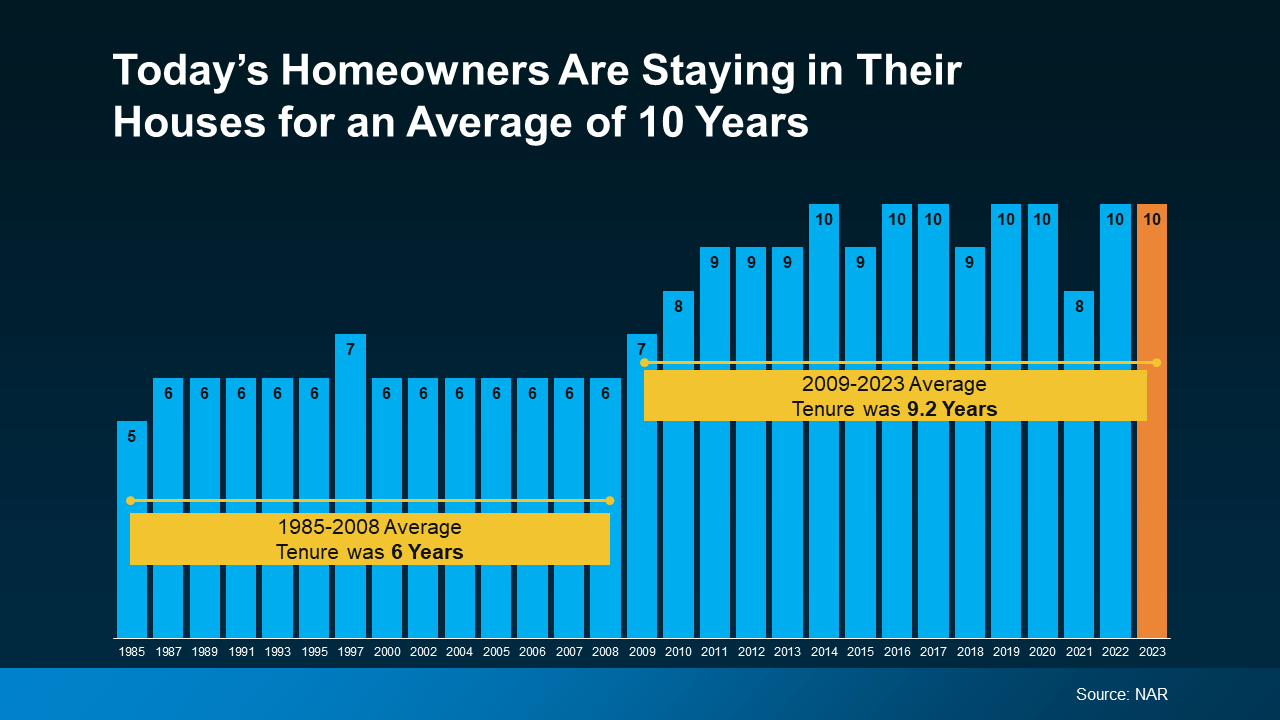

First up is homeowner tenure. That’s how long homeowners live in a house, on average, before selling or choosing to move. From 1985 to 2009, the average length of time homeowners stayed put was roughly six years.

But according to the National Association of Realtors (NAR), that number has been climbing. Now, the average tenure is 10 years (see graph below):

Here’s why that’s such a big deal. You gain equity as you pay down your home loan and as home prices climb. And when you combine all of your mortgage payments with how much prices have gone up over the span of 10 years, that adds up. So, if you’ve lived in your house for a while now, you may be sitting on a pile of equity.

Here’s why that’s such a big deal. You gain equity as you pay down your home loan and as home prices climb. And when you combine all of your mortgage payments with how much prices have gone up over the span of 10 years, that adds up. So, if you’ve lived in your house for a while now, you may be sitting on a pile of equity.

How Home Prices Appreciate over Time

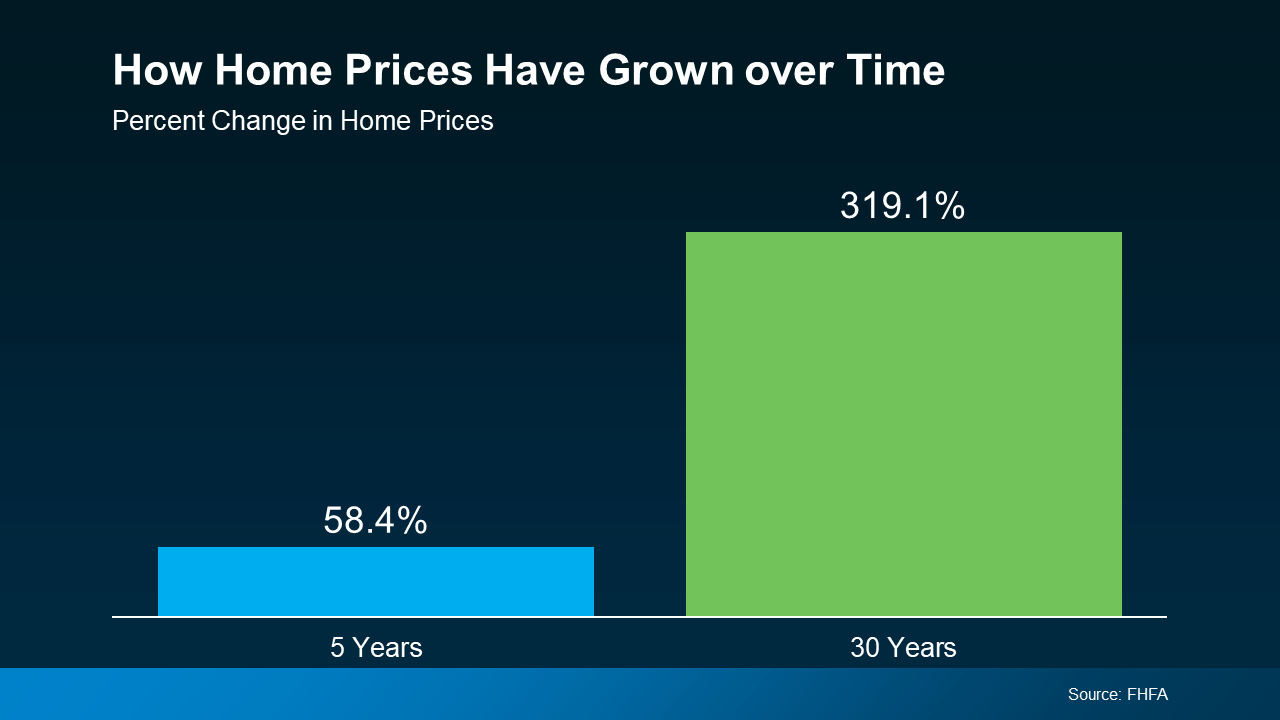

To help show how much the price appreciation piece adds up, take a look at this data from the Federal Housing Finance Agency (FHFA) (see graph below):

Here’s what this means for you. While home prices vary by area, the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it more than triple in value in that time.

Here’s what this means for you. While home prices vary by area, the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it more than triple in value in that time.

Whether you’re looking to downsize, relocate to a dream destination, or move so you can live closer to friends or loved ones, your equity can be a game changer.

Bottom Line

If you want to find out how much equity you’ve built up over the years and how you can use it to buy your next home, let’s connect.

Denver Foothills Property, powered by Compass, is your trusted partner in navigating the unique real estate opportunities of Colorado’s Foothills. From luxury homes to sprawling estates and land, we bring expertise, dedication, and an unmatched understanding of the market. Contact us today to start your real estate journey.

Nick Melzer, JD, founder of Denver Foothills Property, is a seasoned Realtor®, licensed attorney, and the top land broker in Colorado’s Foothills market. Specializing in luxury homes, estates, and land, Nick brings a unique skill set to every transaction, ensuring a seamless and successful experience for his clients.

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).